Soaring PC shipments: Good for Microsoft, not as much for Apple

PC shipments are briskly growing again, in yet another small sign that economic recovery is possible. Today, Gartner and IDC both released preliminary shipments for first quarter. Gartner put shipment growth at 27.4 percent year over year, while IDC growth figures came in a little lower at 24 percent.

But the numbers are mixed, surprisingly. While sales soared in EMEA (Europe, Middle East, Africa) and Asia-Pacific "the U.S. and Latin America were slightly lower than what we had expected," Mikako Kitagawa, Gartner principal analyst, said in a statement. Respectively, PC shipments grew by 24.8 percent, 36.9 percent, 20.2 percent and 35.4 percent. China posted strongest growth -- 45.4 percent.

But double-digit sales growth wasn't the big takeaway, particularly for Microsoft. After more than 18 months of sluggish sales, businesses are finally beginning to buy PCs again. For Microsoft, the news likely means an increase in sales of higherer-margin professional Windows. During the worst of the global economic crisis and the 2008-09 surge in netbook shipments, the sales percentage dramatically shifted to lower-margin consumer Windows.

"With a relatively positive macroeconomic outlook, business demand was more forthcoming," Kitagawa said. "Major PC replacement demand driven by Windows 7 will become more apparent in the second half of 2010 and the beginning of 2011." That's exactly the kind of forecast Microsoft executives want to hear.

But that's the future. The business recovery is still modest compared to consumer sales. In the United States, business PC shipments grew by 10 percent year over year compared to 30 percent for consumers, according to Gartner. There Windows 7, along with aggressive pricing, contributed to unseasonably strong shipments. "Although the first quarter is not typically a strong quarter for the consumer market, growth in the consumer segment was strong," Kitagawa said in the statement. "The positive economic outlook and affordable system prices drove US consumers to buy more PCs. These purchases either replaced aging PCs or became additions to buyers' households."

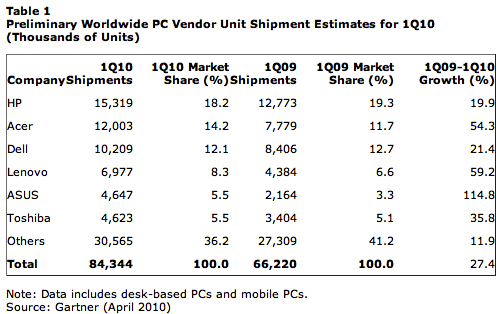

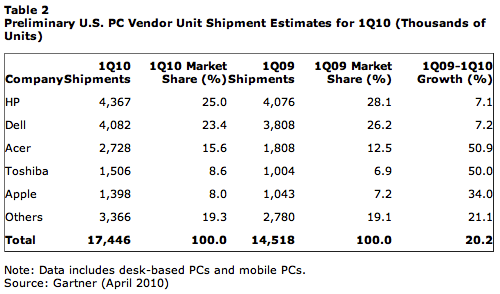

Worldwide, manufacturers shipped 84.3 million PCs during the quarter, according to Gartner. While HP led with 15.3 million PCs in Q1, every other manufacturer in the top five posted stronger growth -- 114.8 percent for ASUS and 59.2 percent for Lenovo, according to Gartner. US PC shipments were 17.4 million units, with Acer and Toshiba both growing about 50 percent. Apple shipped 1.4 million computers, for 34 percent year-over-year growth. However, IDC put Apple shipments lower, at 1.1 million, with growth a much lower 8.3 percent.

Apple ranked fifth in the United States, falling yet another place, with 8 percent market share, down 7.2 percent year over year, according to Gartner. But IDC reported that Apple's market share declined to 6.4 percent, from 7.2 percent. Just two years ago, Apple had risen to third place in US PC shipments. However, despite all the hoopla about increasing Mac sales, Apple US ranking declined, with risk the company might fall back out of the top five in some future quarter.

Gartner and IDC won't tabulate Apple's worldwide ranking until the final figures are released, and generally the information is not publicly available. But the last time I could get data, Q3 2009, Apple ranked No. 7 in worldwide PC market share, according to IDC.

Apple is scheduled to announce second fiscal quarter earnings on April 20. Already, Wall Street consensus is for about 3 million Macs shipped worldwide, which would be on par with the last couple of quarters (3.3 million in the holiday quarter and 3.05 million in calendar Q3 2009). In the year-ago quarter, Apple shipped 2.2 million Macs.

While these numbers are good Apple-on-Apple, recovery of the larger PC market bodes better for competitors. Increases in business sales, particularly those driven by Windows 7 upgrades, will favor Microsoft and its OEM partners. Apple still plays more strongly to consumers, which in part is by design. While Apple markets Macs to businesses, the focus is more on niches, such as content creators; the broader emphasis is the consumer buyer.

Additionally, Apple doesn't much compete for sales below $1,000, where there are larger volumes. So as a measure of unit sales, Apple's ranking will likely continue to decline. However, Apple likely will continue to maintain high revenue share in the premium PC market, which is about 90 percent at US retail.